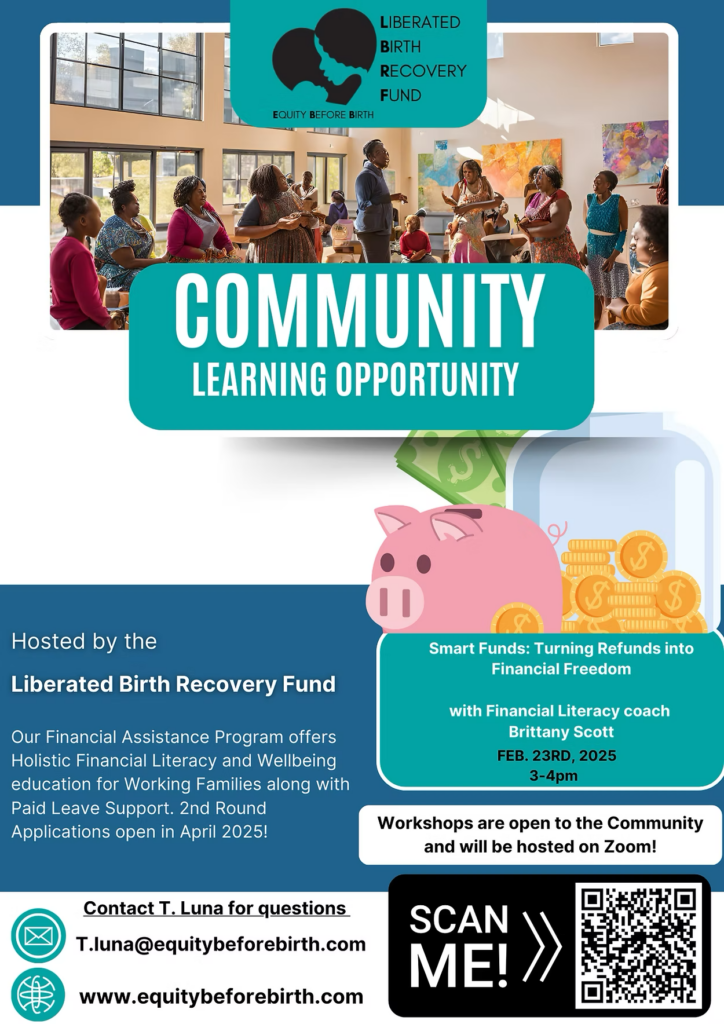

Becoming a parent changes everything—your schedule, your priorities, and especially your finances. For many of us, the transition to parenthood brings unexpected financial challenges, from increased healthcare costs to adjusting to a reduced household income. I wish I’d had access to the Equity Before Birth financial literacy class on February 23, 2025, from 3 to 4 PM, when I was navigating the overwhelming financial shifts of new parenthood.

I remember when I had my first child, my entire financial reality shifted overnight. Suddenly, I had to navigate healthcare expenses, childcare costs, and the loss of income when I unexpectedly left my job to stay home. My spouse took on two jobs to help make ends meet, but it still felt like we were always playing financial catch-up.

With my second baby, I found myself pacing the house with my nursling in a carrier, listening to every audiobook I could find about financial literacy. While my oldest napped, I absorbed everything I could about budgeting, saving, investing, and planning for the future. What I learned fundamentally changed my approach to money and security.

Key Financial Lessons I Learned as a New Parent

1. Understand Your Healthcare Costs

Healthcare can be one of the most unpredictable expenses for new parents. I had no idea what to expect when it came to insurance, co-pays, deductibles, and out-of-pocket costs for prenatal and postnatal care. If I could go back, I would tell myself to:

- Review insurance plans carefully before the baby arrives.

- Look into HSAs or FSAs for medical savings.

- Advocate for covered lactation support through insurance benefits.

2. Create a New Baby Budget

Babies come with a whole new set of expenses—diapers, wipes, clothes, and unexpected medical costs. Some ways I learned to manage:

- Track spending to identify needs versus wants.

- Buy secondhand when possible—gently used baby gear can save hundreds.

- Meal plan and cook at home to avoid overspending on takeout.

3. Learn About Parental Leave & Work Flexibility

I wish I had understood my options for paid leave, unpaid leave, and job protections before I had my child. If you’re expecting, check:

- FMLA coverage and state-specific leave laws.

- Employer policies on remote work or flexible schedules.

- Whether short-term disability can supplement income.

4. Invest in Financial Literacy

One of the best things I did was dedicate time to learning about money. Free resources like library audiobooks, podcasts, and online courses helped me understand:

- How to clean up my credit

- How to budget effectively as a growing family.

- Debt repayment strategies that work for parents.

- Basic investing for long-term financial security.

Financial Literacy Resources for Parents

- Smart Funds: Turning Refunds into Financial Freedom – A free financial literacy workshop hosted by Equity Before Birth and highly recommended for pregnant folks in the Breastfeeding Family.

- Your Money or Your Life by Vicki Robin – A must-read for shifting financial mindset.

- Baby Steps by Dave Ramsey – A structured plan to tackle debt and save.

- ChooseFI Podcast – Practical financial advice for families.

Navigating finances as a new parent is overwhelming, but knowledge is power. Whether you’re figuring out healthcare, budgeting for baby expenses, or trying to build an emergency fund, remember that you’re not alone. There are resources and communities, like Breastfeed Durham, here to support you.